In the wake of numerous high-profile rogue trading incidents that have cost financial institutions billions, traditional control frameworks have shown their limitations. Today, we introduce a dynamic scorecard approach that transforms how firms can monitor, measure, and manage rogue trading risk in real-time.

Moving Beyond Checkbox Compliance

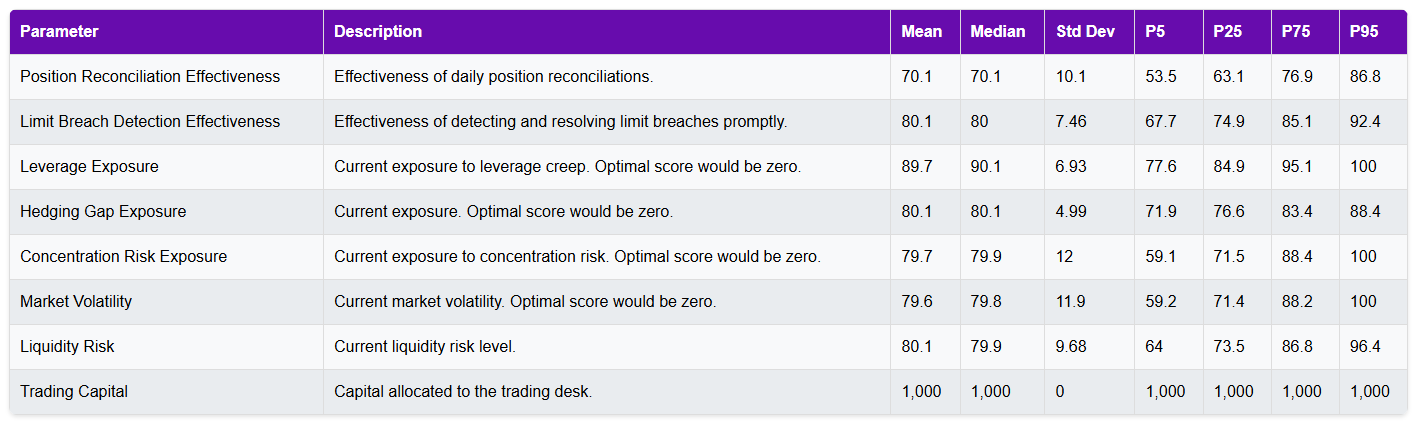

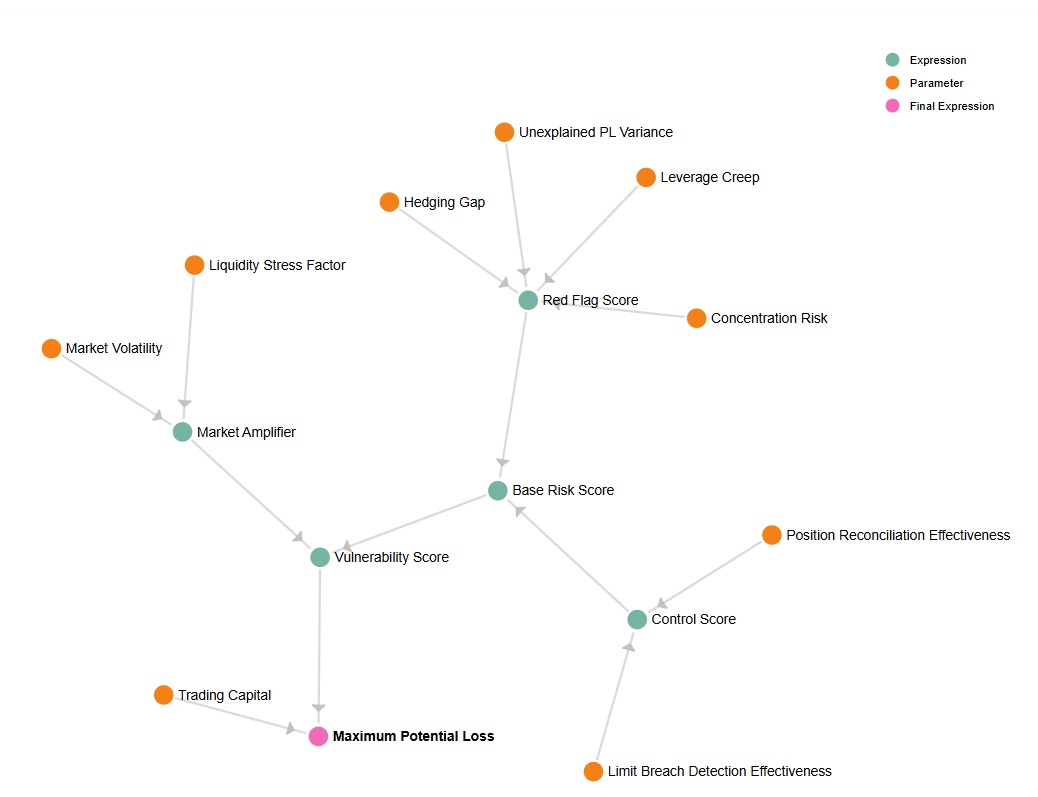

Traditional approaches to rogue trading risk often focus on static control measures – daily reconciliations, limit monitoring, and segregation of duties. While these controls remain crucial, they provide only a snapshot view and can create a false sense of security. Our dynamic scorecard brings these elements together with behavioral patterns and market conditions to provide a holistic view of risk exposure.

The Three Pillars of Dynamic Risk Assessment

1. Control Effectiveness

Rather than simply checking if controls exist, we continuously measure their effectiveness. Are position reconciliations actually catching discrepancies? How quickly are limit breaches detected and resolved? This real-time monitoring helps identify control degradation before it leads to significant exposure.

2. Behavioral Risk Indicators

The scorecard incorporates subtle warning signs that often precede rogue trading incidents:

- Leverage creep in trading positions

- Emerging gaps in hedging strategies

- Growing position concentrations

By monitoring these patterns, firms can spot potential issues while they’re still manageable.

3. Market Context

Market conditions can either amplify or mask rogue trading activity. Our approach factors in:

- Market volatility levels

- Liquidity conditions

- Complex product exposures

This context helps distinguish between genuine market stress and potential unauthorized activity.

Actionable Intelligence for All Stakeholders

The scorecard translates complex risk metrics into clear, actionable intelligence for different audiences:

- Front Line Managers: Early warning indicators for immediate action

- Risk Committees: Trending analysis and emerging risk patterns

- Board Level: Strategic overview of control effectiveness and capital at risk

- Regulators: Evidence of proactive risk management and control framework effectiveness

Moving from Reactive to Predictive

Perhaps most importantly, this approach shifts the focus from reactive incident management to predictive risk control. By simulating various scenarios and stress conditions, firms can:

- Identify control weaknesses before they’re exploited

- Quantify potential exposure under different market conditions

- Optimize resource allocation for risk management

- Demonstrate regulatory compliance with evidence-based metrics

The Bottom Line

Rogue trading remains one of the most significant operational risks facing financial institutions. This dynamic scorecard approach provides the tools needed to:

- Monitor risk exposure in real-time

- Detect control deterioration early

- Quantify potential losses more accurately

- Enable faster, more informed responses to emerging risks

In an era of increasing trading complexity and market volatility, staying ahead of rogue trading risk requires more than just strong controls – it requires intelligence. This scorecard provides exactly that.

Want to learn more about implementing a dynamic risk scorecard at your institution? Contact me to discuss of how this approach can strengthen your control framework.