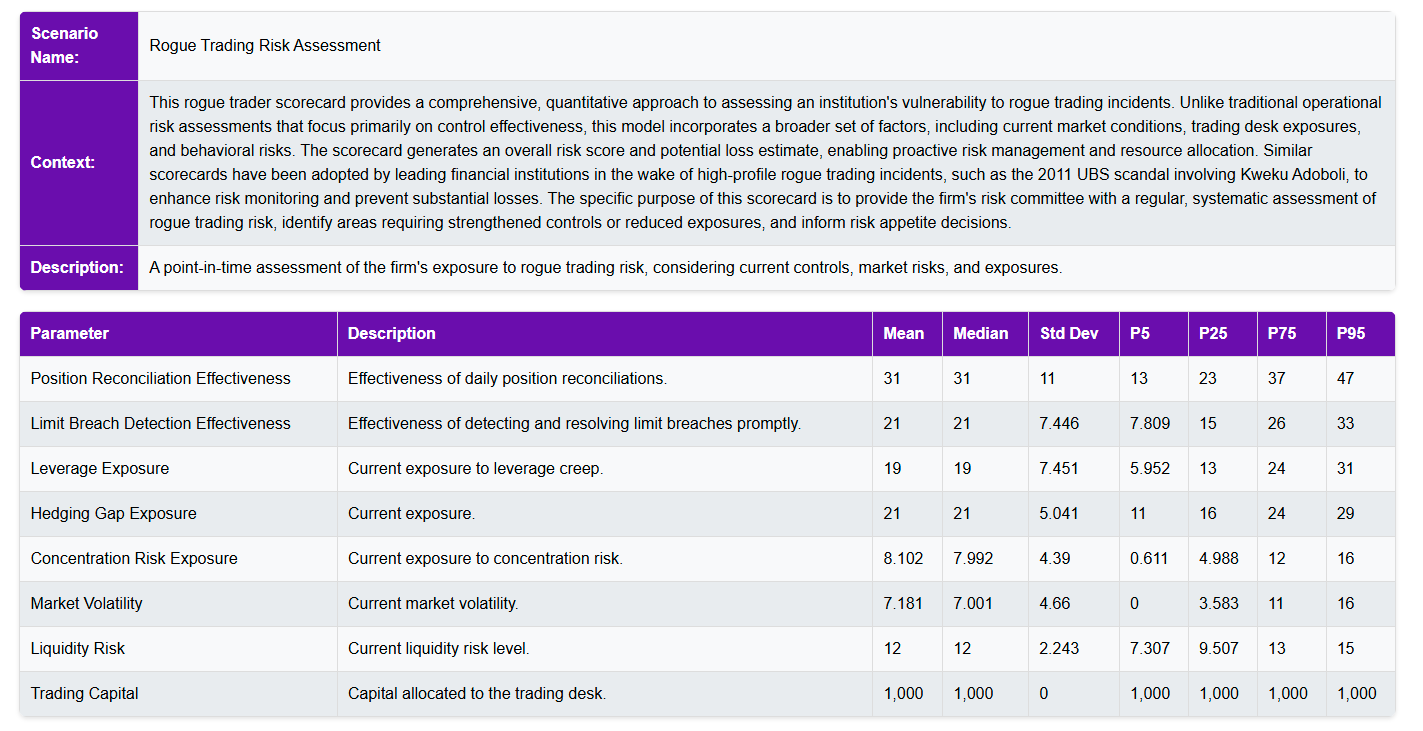

This rogue trader scorecard provides a comprehensive, quantitative approach to assessing an institution’s vulnerability to rogue trading incidents.

Unlike traditional operational risk assessments that focus primarily on control effectiveness, this model incorporates a broader set of factors, including current market conditions, trading desk exposures, and behavioral risks. The scorecard generates an overall risk score and potential loss estimate, enabling proactive risk management and resource allocation. Similar scorecards have been adopted by leading financial institutions in the wake of high-profile rogue trading incidents to enhance risk monitoring and prevent substantial losses.

The specific purpose of this scorecard is to provide the firm’s risk committee with a regular, systematic assessment of rogue trading risk, identify areas requiring strengthened controls or reduced exposures, and inform risk appetite decisions.

In this rogue trader risk assessment scorecard, the frequency is set to 1 (or 100%) for all assessments because the scorecard is designed to provide a comprehensive, point-in-time evaluation of the firm’s current exposure to rogue trading risk. The assessments are not meant to represent the likelihood of specific events occurring, but rather to capture the potential impact of various risk factors on the overall risk profile.

By setting the frequency to 100%, the scorecard ensures that each risk factor is fully considered in the analysis, providing a complete picture of the firm’s vulnerabilities. This approach allows risk managers to identify areas requiring immediate attention and make informed decisions about risk mitigation strategies.

How the scorecard works:

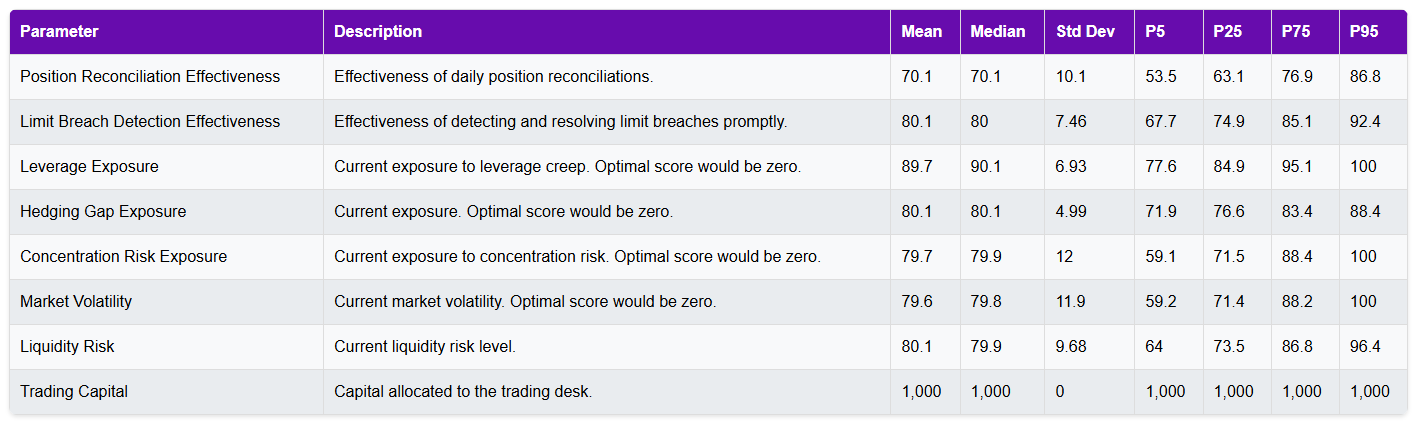

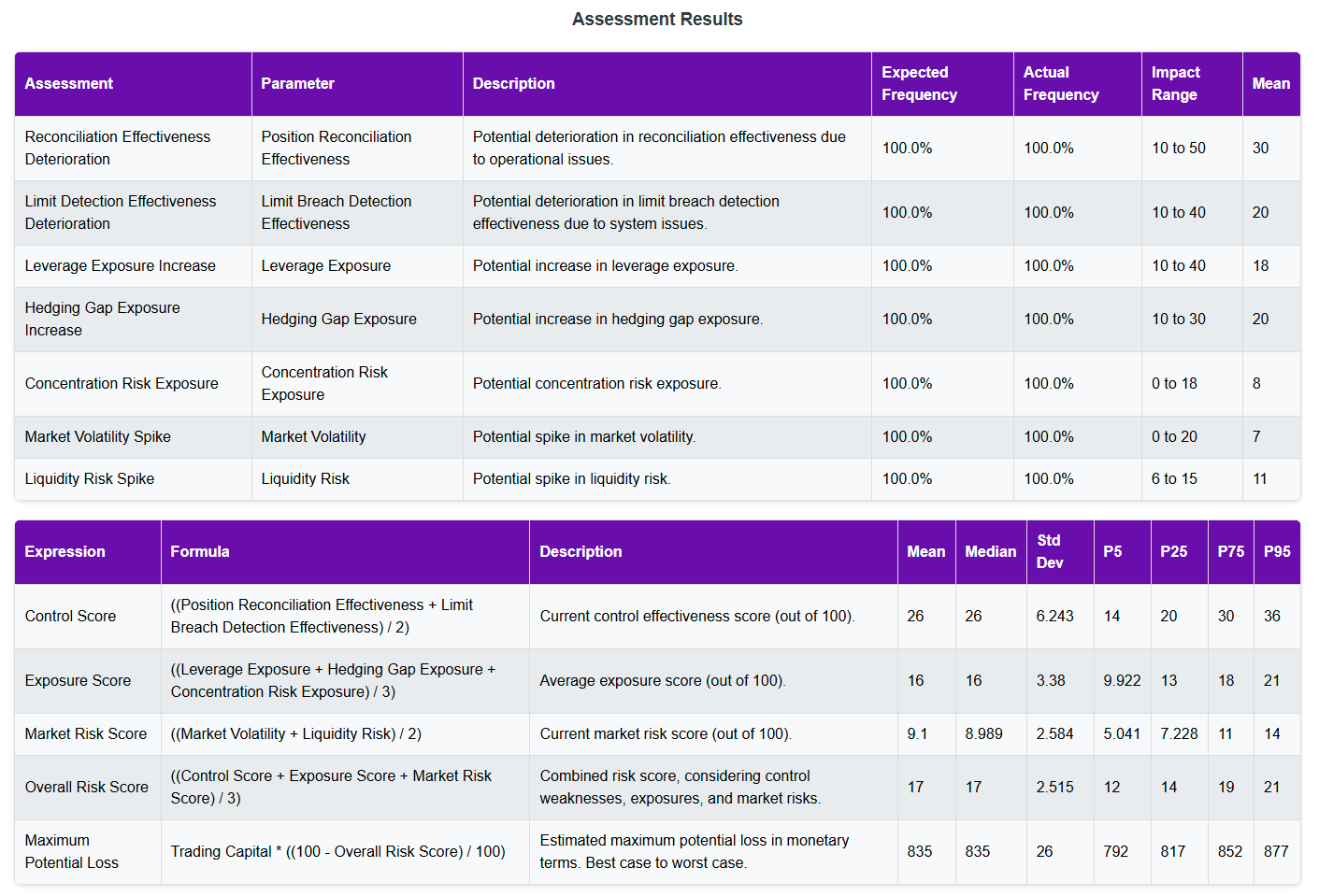

- The scorecard consists of several parameters that represent different aspects of rogue trading risk, including control effectiveness, behavioral exposures, and market risks.

- Each parameter is assigned a base value that represents the current state or level of the risk factor. Assessments are then applied to these parameters to simulate potential changes or deteriorations in the risk environment.

- The assessments have upper and lower bounds which define the range and mean impact of each risk factor. These values are used to generate a distribution of possible outcomes for each parameter.

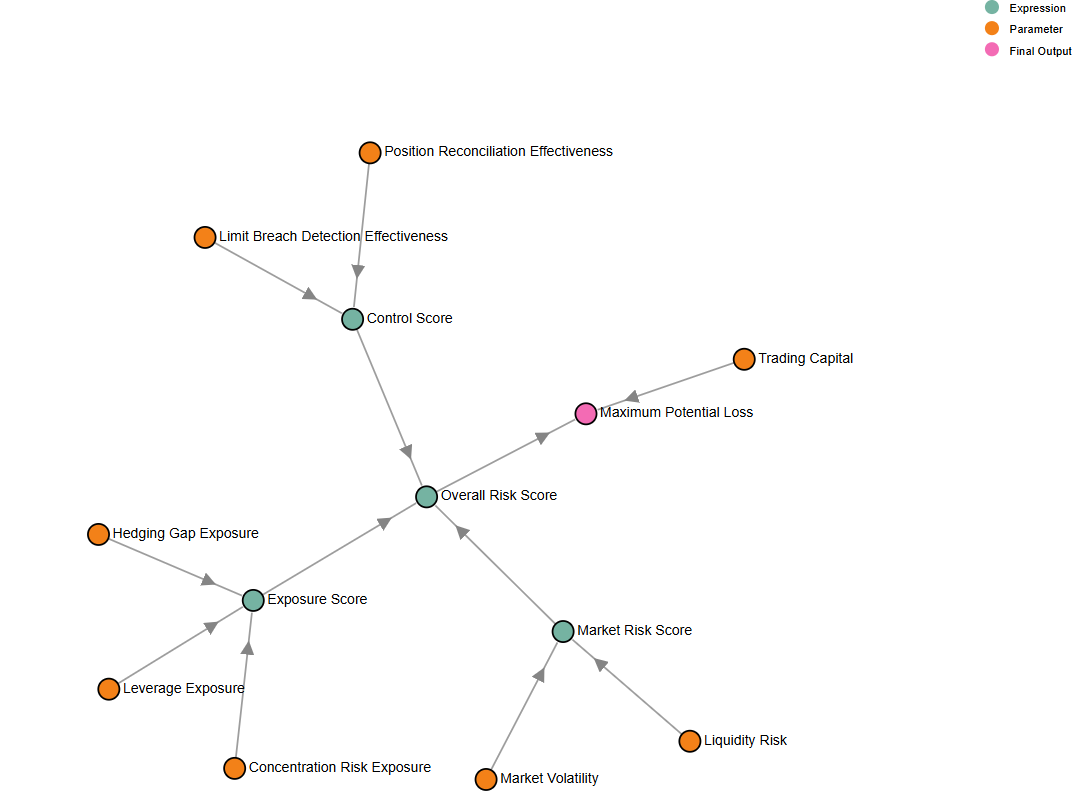

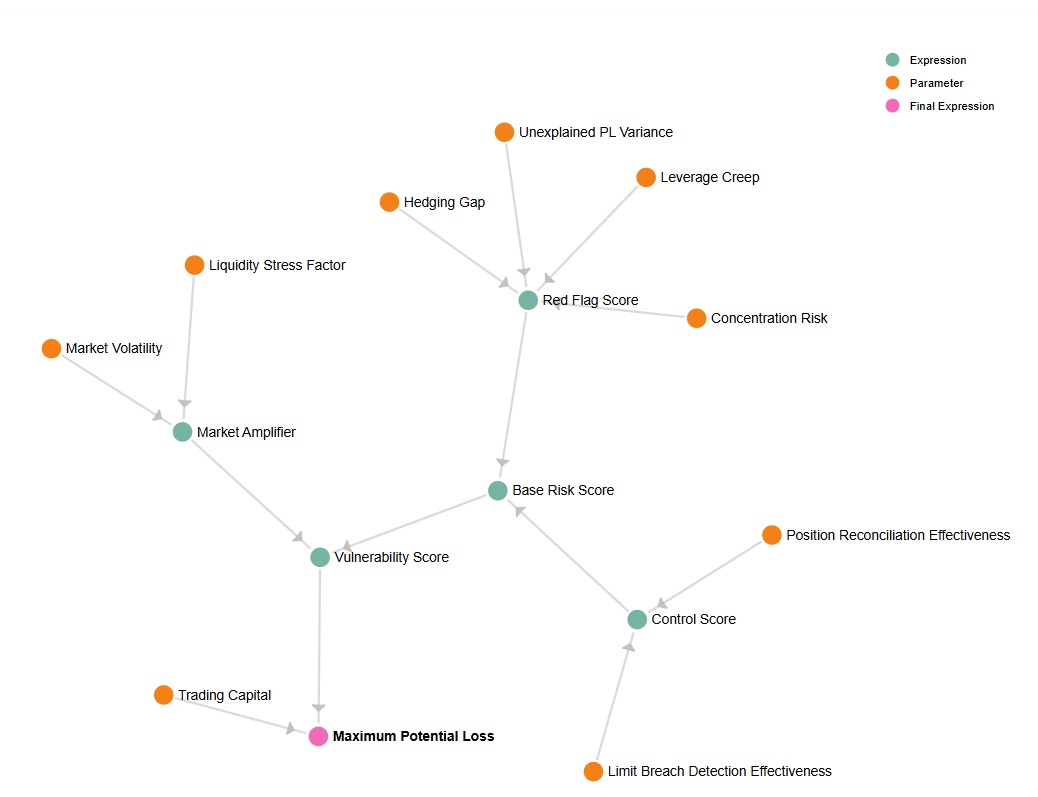

- Expressions are used to calculate aggregate risk scores, such as the Control Score, Exposure Score, and Market Risk Score. These scores are then combined to generate an Overall Risk Score, which provides a comprehensive measure of the firm’s vulnerability to rogue trading risk.

- The Maximum Potential Loss expression estimates the monetary impact of the risk exposure, based on the Overall Risk Score and the Trading Capital allocated to the desk.

- Scenario Impact Metrics define thresholds for triggering alerts or actions based on the results of the risk assessment. These metrics help risk managers identify when the risk profile exceeds acceptable levels and prompt timely interventions.

Benefits of this approach:

- Comprehensive risk assessment: The scorecard provides a holistic view of rogue trading risk by considering a wide range of factors, including control effectiveness, behavioral exposures, and market risks. This comprehensive approach ensures that all key aspects of the risk are captured and evaluated.

- Proactive risk management: By generating a point-in-time assessment of the firm’s risk profile, the scorecard enables risk managers to identify areas of concern and take proactive measures to mitigate potential losses.

- Informed decision-making: The scorecard generates quantitative risk scores and potential loss estimates, which provide risk managers with objective, data-driven insights into the firm’s risk exposure. These insights can inform strategic decisions, such as adjusting risk appetites, allocating resources, or strengthening controls in specific areas.

- Enhanced monitoring and reporting: The scorecard can be used to monitor changes in the firm’s risk profile over time, allowing risk managers to track the effectiveness of risk mitigation efforts and identify emerging trends or vulnerabilities. Regular reporting based on the scorecard results can also improve transparency and accountability within the organization.

- Regulatory compliance: By demonstrating a robust and systematic approach to assessing and managing rogue trading risk, the scorecard can help firms meet regulatory expectations and industry best practices. This can enhance the firm’s reputation and reduce the risk of regulatory interventions or penalties.

In summary, the rogue trader risk assessment scorecard provides a comprehensive, data-driven approach to evaluating and managing the complex risks associated with rogue trading. The scorecard ensures a complete and timely analysis of the firm’s risk profile, enabling proactive risk management and informed decision-making.