Insights from Monte Carlo Analysis

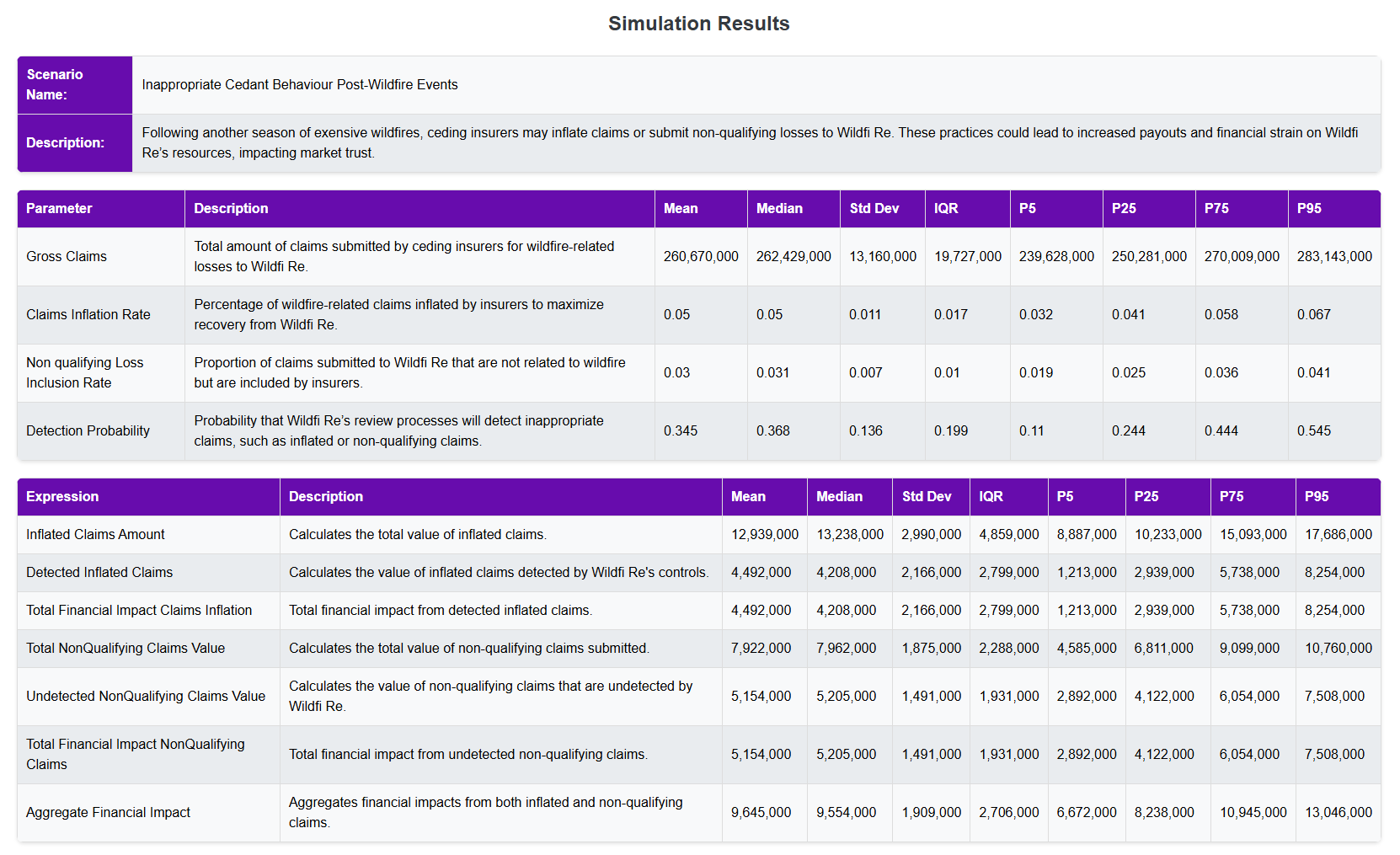

In the aftermath of a series of hot, dry summers, UK specialist reinsurer Wildfi Re, is exposed to operational risk associated with claims behaviour. The scenario assumes that ceding insurers may, through control or process failings, inflate claims or include non-qualifying losses. Using Monte Carlo simulation, scenario analysis offers insight into the potential financial impacts of these claims on Wildfi Re, illustrating the importance of its own detective controls and processes to manage both expected and unexpected claims behaviour.

Insights from Monte Carlo Simulations on Claims

Our Monte Carlo simulation indicates several key dynamics related to claims inflation, non-qualifying claims inclusion, and the effectiveness of Wildfi Re’s detection mechanisms. In our scenario, the potential for claims inflation is modeled with a mean rate of 5%, though it could vary, with a range extending up to 6.7% (P95). This implies a mean value of inflated claims amounting to almost £13 million.

Wildfi Re’s current detection processes, modeled to capture inappropriate claims at a probability of approximately 35%, reveal that around £4.5 million of the inflated claims might be detected based on existing controls, while the remaining inflated claims are likely to go undetected, representing a sizable financial risk.

Non-qualifying claims—those unrelated to wildfire losses but included in submissions—pose a further potential impact. These claims are modeled to occur at a rate of 3% and could amount to £7.9 million. With the same detection probability, undetected non-qualifying claims may cost Wildfi Re approximately £5.1 million.

Assessing the Aggregate Financial Impact

The total financial impact from both inflated and non-qualifying claims underscores the limitations of Wildfi Re’s current review processes. The combined impact from detected and undetected claims is modeled to reach an average of £9.6 million.

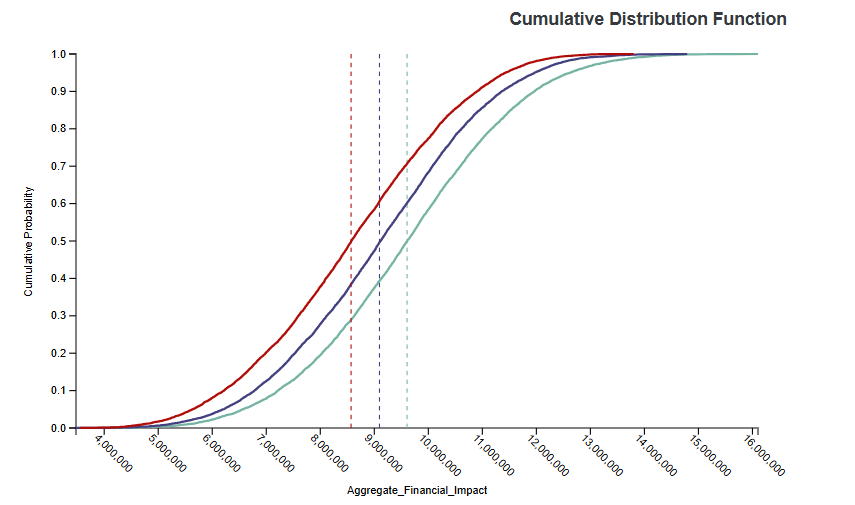

The financial implications highlight a key operational challenge for reinsurance firms like Wildfi Re. Large-scale wildfile events often bring high volumes of complex claims, where small increases in claims or misclassifications can translate into significant financial exposure. For a reinsurance firm, strengthening detection and review protocols could help address the limitations highlighted in the scenario analysis. Higher detection rates could provide added assurance against the financial impacts of insurer cedant behaviour, supporting Wildfi Re’s long-term financial resilience.

Cumulative Distribution of Aggregate Financial Impact under Varying Detection Rates (7%, 5%, and 3%) – Projected Impact of Enhanced Detection on Financial Exposure.

Industry Context: The Expanding Role of Simulation in Operational Risk Management

Within operational risk, Monte Carlo simulations are valuable tools for assessing both frequent and rare but high-impact scenarios. By using simulations to gauge the financial effects of complex risk behaviours, firms can more accurately quantify potential exposures and adapt their risk management strategies accordingly.

Through this analysis, the scenario underscores how simulation-based models provide insight into the potential financial cost associated with claims practices following high-impact events, insights that could strengthen Wildfi Re’s approach to operational risk management.