During a thematic review of lending practices, internal audit identifies systematic errors in how the mortgage affordability calculator handles self-employed income. The calculator is found to be overstating sustainable income by 15-25% due to:

(1) inappropriate treatment of variable income components,

(2) incorrect handling of business expense deductions, and

(3) inadequate consideration of income volatility in stress scenarios.

The issue affects 18 months of originations, impacting approximately 3,000 mortgages that require detailed review and possible remediation. Initial sampling suggests higher-risk cases are concentrated among specific broker chains, indicating possible systematic gaming of known weaknesses in the affordability assessment process.

The affected portfolio represents about £500m in lending, predominantly to self-employed professionals and small business owners. File reviews indicate that while most cases remain within acceptable affordability parameters even after correction, a significant minority may face stress if interest rates increase or business income declines.

Remediation requires:

1. Full review of all self-employed mortgages originated during the period

2. Detailed reassessment of affordability using corrected calculations

3. Implementation of enhanced broker monitoring controls

4. Potential redress for cases where lending was clearly inappropriate

5. Regulatory engagement and possible Section 166 Skilled Person Review

Additional complexity arises from:

– Potential for broader systemic issues in other lending processes

– Regulatory focus on treatment of vulnerable customers

– Reputational risk in the broker and SME banking community

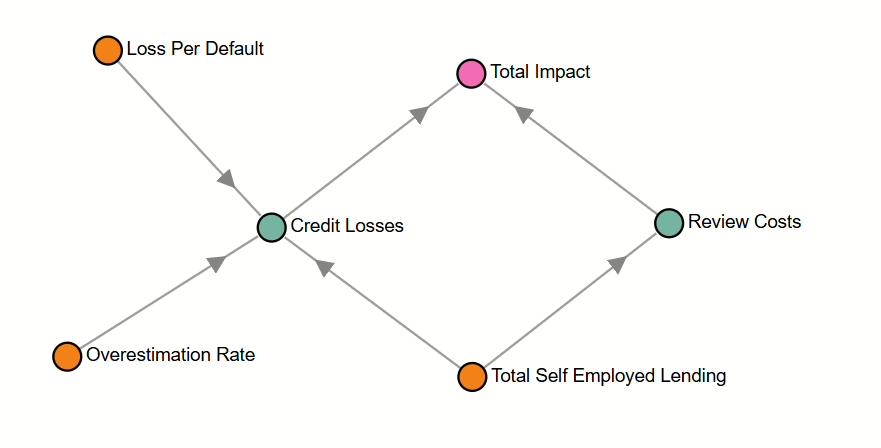

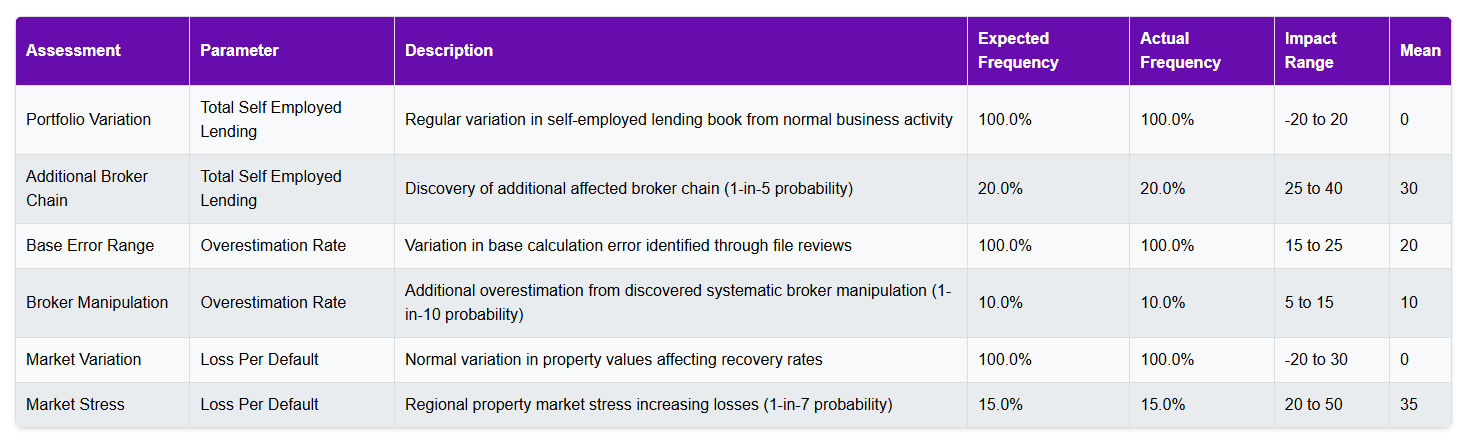

The scenario considers both immediate financial impacts through credit losses and review costs, as well as potential amplification through market stress conditions or discovery of systematic broker misconduct.

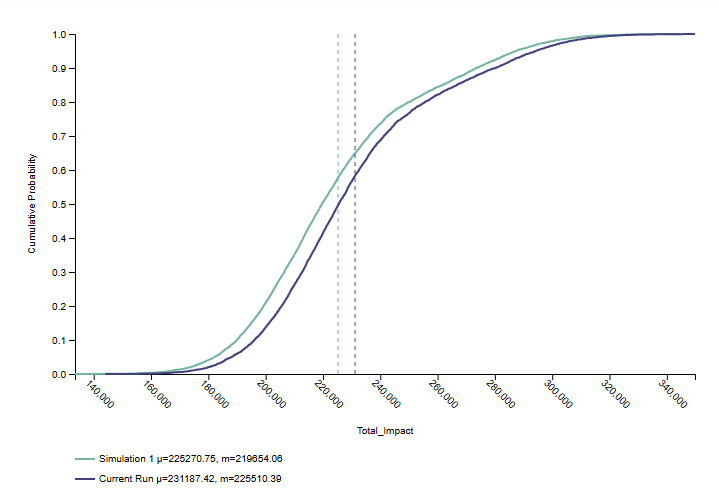

Summary of Simulation Results

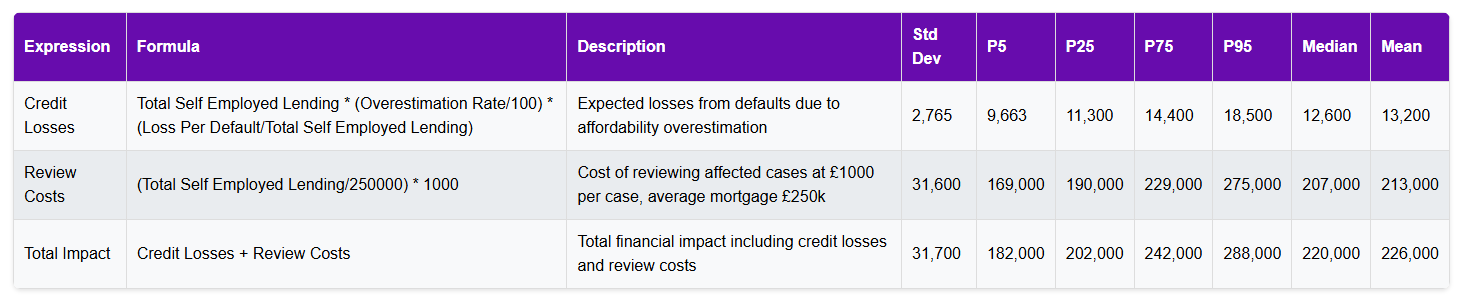

The simulation models the financial impact of mortgage affordability calculation errors affecting self-employed borrowers, combining both credit losses and operational review costs.

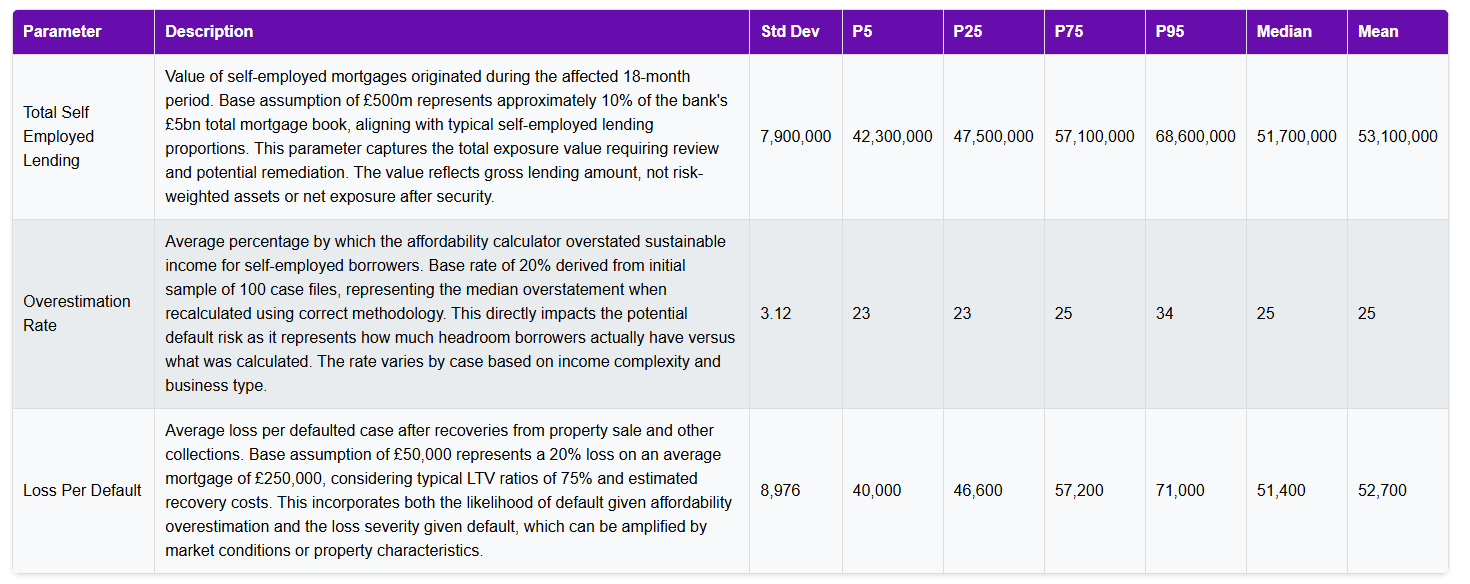

Exposure and Portfolio Characteristics

- The affected self-employed lending portfolio averages £53.1m, with 90% of scenarios falling between £42.5m and £68.5m

- This shows moderate variability (std dev £7.8m) reflecting both regular portfolio fluctuations and potential discovery of additional affected cases

- The portfolio size distribution is slightly right-skewed, suggesting more upside risk in the exposure amount

Impact Components

- Credit Losses

- Mean credit loss of £13,200 with standard deviation of £2,848

- 90% confidence interval ranges from £9,753 to £18,600

- Driven by average overestimation rate of 26% and mean loss per default of £52,800

- Notable tail risk with 95th percentile at £18,600, about 41% above mean

- Review Costs

- Average review cost of £213,000, representing bulk of total impact

- More stable than credit losses (CoV = 14.7%)

- Scales directly with portfolio size at £1,000 per £250,000 of lending

- 90% of scenarios between £169,000 and £274,000

Total Financial Impact

- Expected total impact of £226,000 (median £220,000)

- Distribution shows moderate right skew with 95th percentile at £288,000

- Operational review costs dominate the average impact (94% of mean)

- But credit losses show greater variability and contribute more to extreme scenarios

Risk Drivers

- Primary driver is scale of affected portfolio requiring review

- Credit losses show higher variability due to compounding of:

- Overestimation rate uncertainty (mean 26%, std dev 3.17%)

- Loss per default variability (mean £52,800, std dev £8,962)

- Operational costs provide stable base impact with credit losses adding tail risk

Stress Considerations

- 95th percentile total impact (£288,000) represents 31% increase over mean

- Worst cases driven by combination of:

- Larger affected portfolio discovery

- Higher overestimation rates

- Adverse property market conditions affecting recovery rates

The results suggest this is primarily an operational risk event with a credit risk overlay. While review costs provide a stable baseline impact, the potential for significant credit losses in stress scenarios shouldn’t be overlooked.