Crunching the Numbers on Production and Savings

Before committing to any major decision, it’s smart to crunch the numbers. And that’s exactly what ACME Donuts is doing as they consider leasing a new production machine. The hope? Lower maintenance costs, labor savings, and fewer raw material expenses. But, as we know, there’s always some uncertainty in business—so they’re turning to a simulation to predict what might happen in different scenarios.

What’s at Stake?

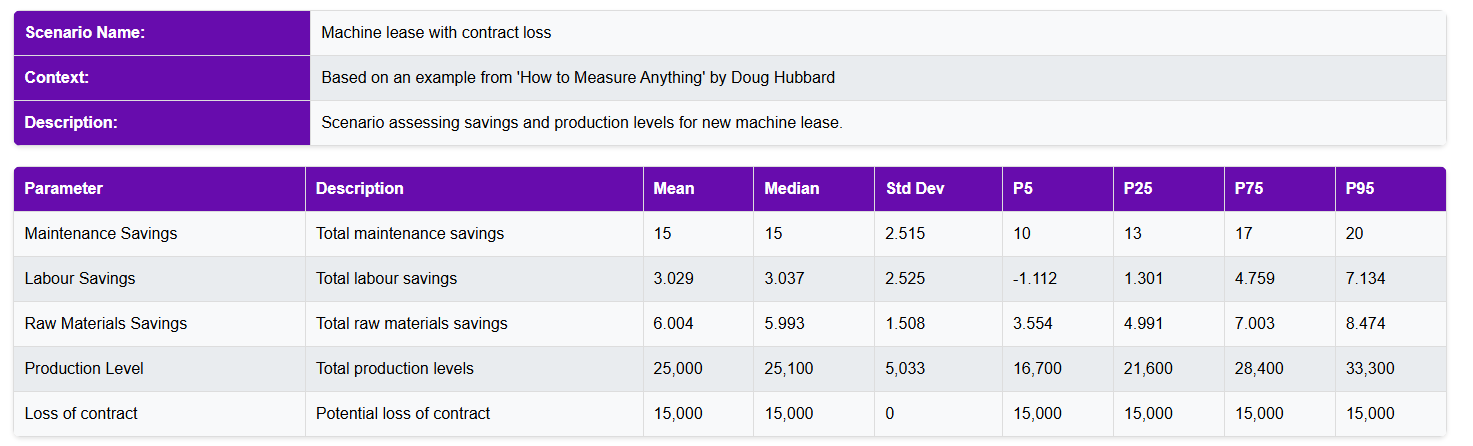

The company is diving into the numbers to assess how much they can save with a new machine lease. They’re looking at savings across three key areas—maintenance, labor, and raw materials—but there’s quite a bit of variability in each of these categories. Let’s break it down:

Maintenance Savings:

The simulation estimates that the company will save about £15 per unit in maintenance costs. However, these savings could vary from a low of £10 to as much as £20 per unit. While maintenance savings seem like a safe bet, the range shows how fluctuating repair needs could influence the final amount.

Labor Savings:

This area comes with the widest swing. The company hopes for £3 in labor savings per unit, but this is far from guaranteed. The simulation shows a possible range from £8 in savings per unit down to a loss of £2 per unit. Yes, the new machine could potentially cost more in labor if it requires extra hands or more expensive hands to operate effectively. It’s crucial for the company to account for this potential downside in their planning.

Raw Materials Savings:

As for raw materials, the company expects to save about £6 per unit. But, much like labor and maintenance, this isn’t set in stone. Depending on how efficiently the new machine uses materials, savings could range from £3 per unit on the low end to £9 per unit on the high end.

Running the Numbers on Production Levels

Of course, it’s not just about saving money—it’s about producing enough units to make the lease worthwhile. The company expects to typically produce around 15,000 units, but depending on how things shake out, that number could rise to 29,000 or drop to as low as 4,800 units.

The simulation helps them understand the variability. Even though they’re aiming for high production, the uncertainty around different factors—like demand, machine efficiency, and external influences—means they need to account for all possibilities.

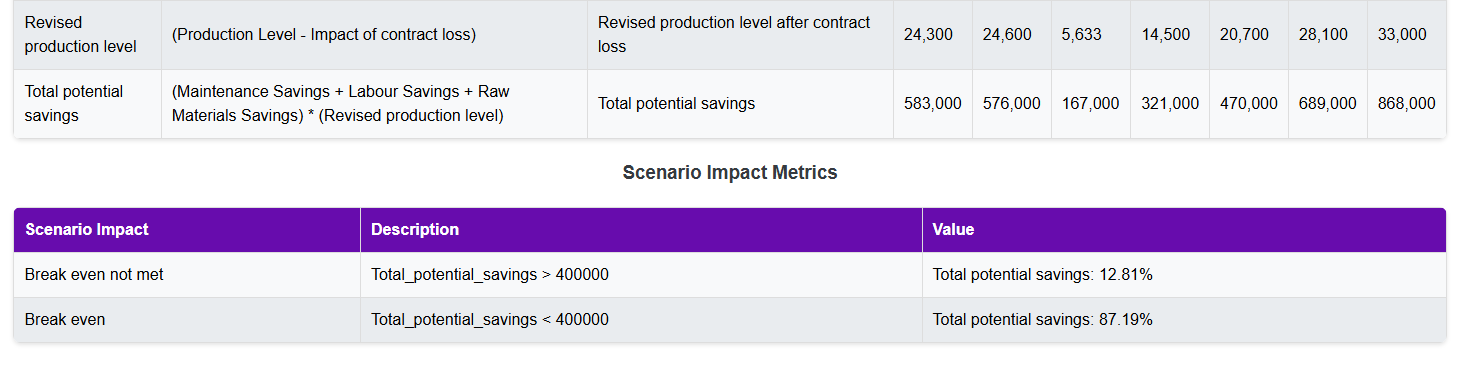

The “What If?” Scenario: Losing a Contract

Now, let’s talk about one specific scenario: What if the company loses a major contract?

Losing the contract isn’t a given – it’s only a 10% chance—but they want to see how losing an order for 5,000 units would affect their numbers. The impact also depends on when that loss happens; if it occurs early in the year, they’d feel the sting more, but even so, the analysis shows they could still produce around 20,000 units. So, while a contract loss would be inconvenient, it’s wouldn’t be a calamity.

The value of this scenario isn’t that the company expects it to happen—it’s that the simulation shows how they could prepare if it did. Planning for the unexpected, even unlikely events, helps build resilience into their business.

Will They Hit Their Savings Target?

So, what do the numbers say?

If the same scenario were played out thousands of times—as is done in a Monte Carlo simulation—the expected savings for the company would be around £583,000. This represents the average outcome. However, there’s a 1-in-20 chance (95th percentile) that savings could exceed £868,000, and on the other hand, there’s an equal 1-in-20 chance (5th percentile) that savings could fall below £321,000. While these outcomes represent the extremes, they help the company see the full range of possible outcomes before making a final decision.

What the Company Can Learn from This

This simulation provides invaluable insights into how different factors—both expected and unexpected—can impact their bottom line. By running scenarios, they can see where their biggest risks lie, whether it’s lower-than-expected savings on labor, variability in production levels, or the unforecast loss of a contract.

More than anything, Monte Carlo simulation gives them confidence—they know what to expect in most situations, and they’re prepared for the outliers. Whether they move forward with the lease or adjust their plans, they’ll be making a well-informed decision backed by appropriate analysis.