Unpacking the True Costs of Operational Risks

Over the weekend, TrustePensions implemented a routine update to their in-house pension management system, “PensionFlow.” On Monday morning, operations at their Birmingham headquarters resumed as usual, with client transactions processing through the system, allocating funds to various pension accounts. However, an untested piece of code was included in that update—a small oversight in the release process that would soon cause a significant issue.

Among the thousands of accounts managed by TrustePensions, approximately 100 were engaged in high-value transactions, including large pension withdrawals, annuity purchases, and mid-cycle contributions. These transactions require manual processing and additional layers of validation to ensure accuracy and compliance. The untested code inadvertently misallocated client funds across these 100 accounts.

By midday, a few clients had noticed discrepancies in their account balances. Initially, these anomalies were assumed to be routine market fluctuations, and customer service handled them accordingly. However, as the afternoon progressed and the end-of-day reconciliation began, the reconciliation team, led by Daniel Lewis, began noting the discrepancies. A detailed investigation revealed the misallocation caused by the weekend release, necessitating immediate action.

The response was swift: Simon Turner, the Chief Technology Officer, halted all new transactions and rolled back the update. Reprocessing the day’s transactions, verifying data accuracy, and restoring correct balances was a labor-intensive effort, extending well beyond normal operating hours. TrustePensions would have to suspend pension contributions and adjustments for the affected clients—potentially adding to the complexity of each reconciliation.

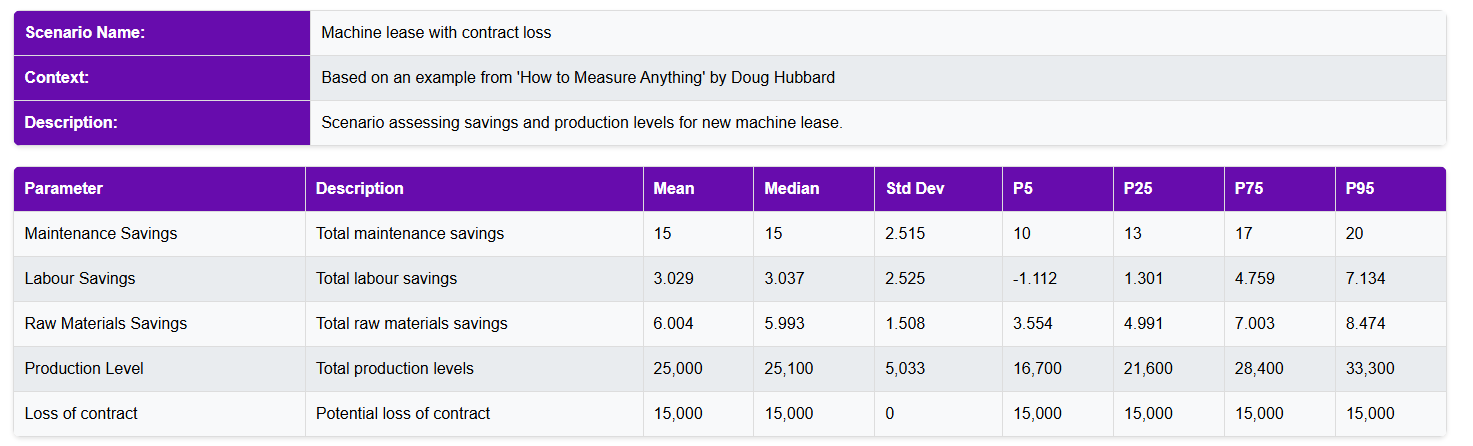

Compounding the challenge, there was a 20% chance that an additional cohort of clients—estimated between 50 to 100 accounts—might also require reconciliation, potentially increasing the workload. These accounts involved complex transactions that couldn’t be swiftly automated, necessitating manual intervention and increasing the risk of further errors.

Reconciliation: The Real Picture

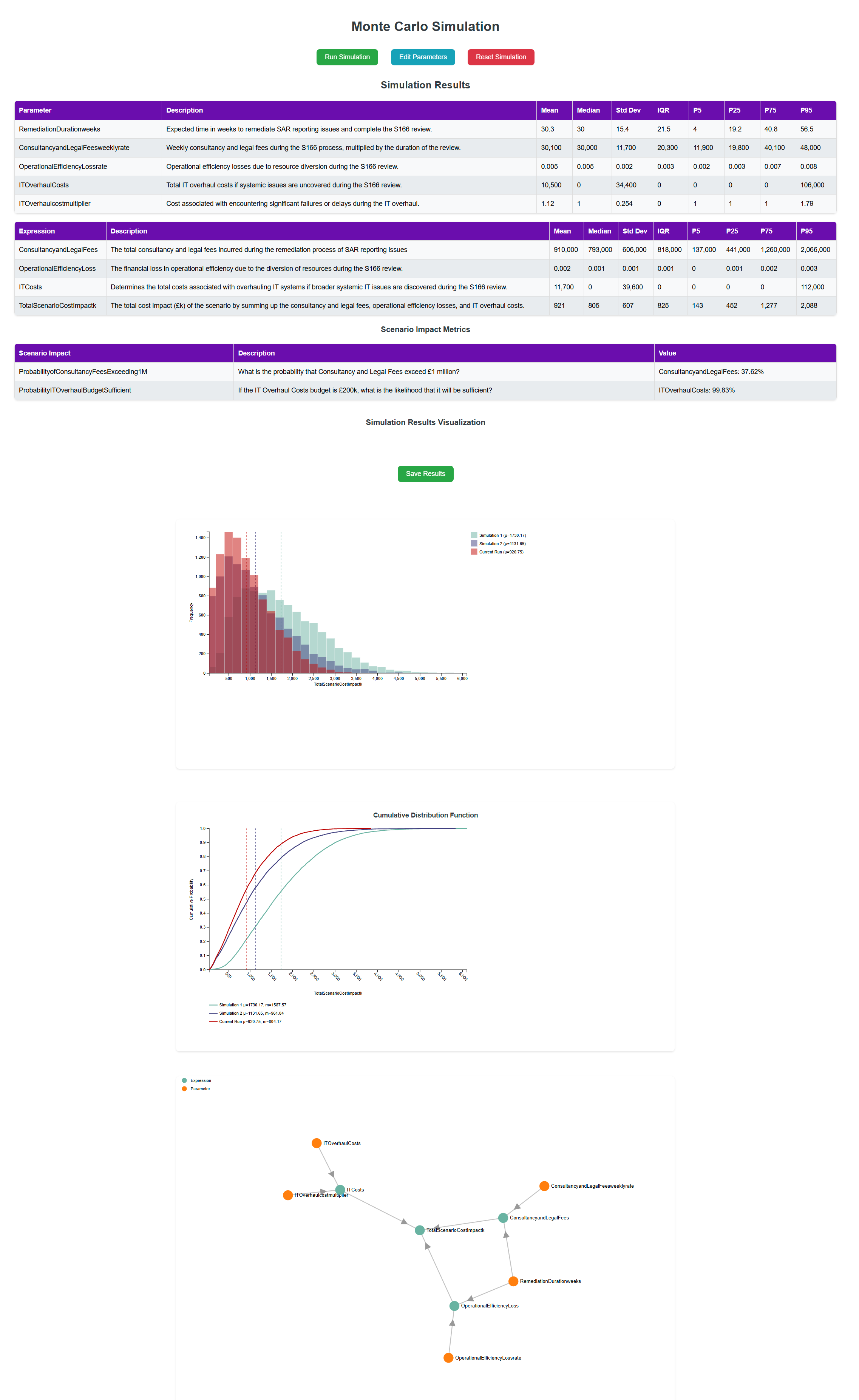

For TrustePensions, a firm with a zero-tolerance policy on client money misallocations, the real challenge is not just how long reconciliation will take—but how quickly the issue can be resolved. The firm needs to know it is operationally resilient because, according to the Monte Carlo simulation, the total effort required to resolve the misallocation averages 15.6 days of work if handled by a single person.

The practical implication is that 16 staff members would need to be fully dedicated for an entire day to bring client accounts back in line. This raises critical questions: Does TrustePensions have the capacity to handle this in-house, or will they need to outsource the reconciliation effort? Internal teams may be stretched thin or lack the expertise needed to handle such a large, rapid reconciliation task.

This underscores the importance of resilience in effective risk management—not just estimating how long it may take to recover, but ensuring the right people, with the right skills, are available when needed.

Operational Resilience: A Board-Level Issue

In this scenario, the real challenge lies in resolving the issue within the firm’s zero-tolerance policy on client money misallocations. TrustePensions must immediately determine whether it has the internal capacity to redeploy staff or if external consultants need to be brought in—skilled, fast, and available on the same day—to ensure the issue is fully reconciled as soon as possible. Missing this deadline wouldn’t just breach internal thresholds—it would likely set off alarm bells with the FCA.

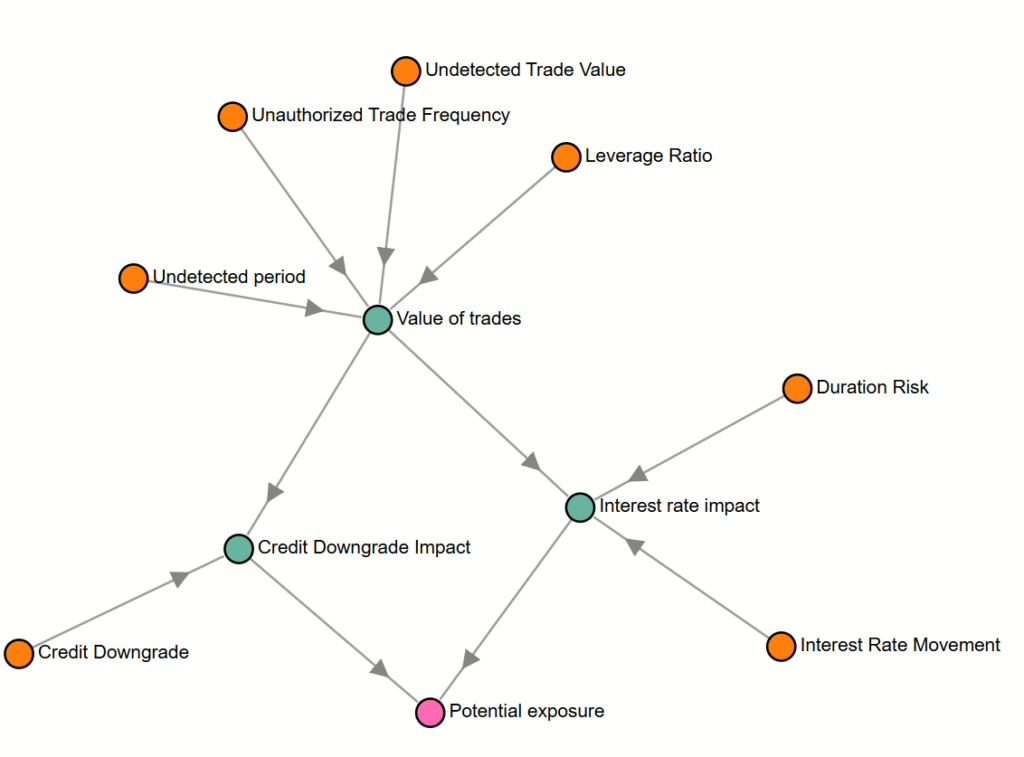

This is where the Key Risk Indicators (KRIs), tested through the scenario simulation, come into play. The KRI threshold isn’t just a nice-to-have—it’s an early-warning trigger. It tests whether the firm can mobilise sufficient, qualified resources to compress what would normally be a multi-week reconciliation process into a single day. This is not business as usual, and the Board must ensure that these KRIs serve as real action points—not hypothetical markers.

KRIs should prompt an immediate response whether triggered by live events or through plausible scenario simulations. The Board must shift its focus to ensuring that the firm’s operational resilience can meet the demands of these KRIs. The goal is simple: avoid breaching the trust of both clients and regulators by ensuring the firm is always ready to respond swiftly and effectively.

Financial Impact: Beyond Initial Estimates

The incident was projected to cost £15,600, based on the updated estimate of time and cost:

This projection assumes an average external resource rate of £2,000 per day, with each day covering an eight-hour shift. Reconciling 100 client accounts would take approximately 1 hour per account, or about 15.6 days in total.

However, the zero-tolerance policy makes this a far more complex operational challenge. Rather than spreading the workload across many days, the firm must concentrate the effort into a single day. Furthermore, the simulation has challenged a number of baseline assumptions, meaning the resulting analysis suggests the firm needs to effectively compress 15.6 days’ worth of work into just 24 hours.

The cost implications extend beyond just time. TrustePensions must determine whether it could pull in internal teams, which would strain other operations, or whether it could secure enough skilled external consultants to handle the volume of work. Either option will add significantly to the overall cost and bring their own risks. Based on our simulation, the financial impact is expected to be nearer £61,700, with the potential to reach £123,000 if additional cases are identified.

Beyond the ripple effect of operational risk costs due to urgency and skilled resourcing, this scenario reveals a key takeaway: what starts as an impact assessment of a client money misallocation can become a resilience testing opportunity. The significantly increased financial implications emphasise the need for TrustePensions to invest in advanced reconciliation tools, enhance staff training, and establish robust incident response protocols to effectively manage and mitigate such risks.